Acquisitions are often seen as a growth strategy, whether to enter a new market, expand product lines, gain intellectual property, or capture a valuable customer base.

However, many acquisitions fail to realize their intended value. As a CEO considering the acquisition of another company, you’re likely familiar with the high stakes involved.

Having personally worked through over 30 successful integrations in my career, I’ve learned that while every acquisition is unique, certain principles can help guide you through the complexities of integration.

In this article, I’ll share some observations to help you navigate your role as a CEO in an acquisition. With this, you can evaluate your unique situation and create a focused action plan for successful integration.

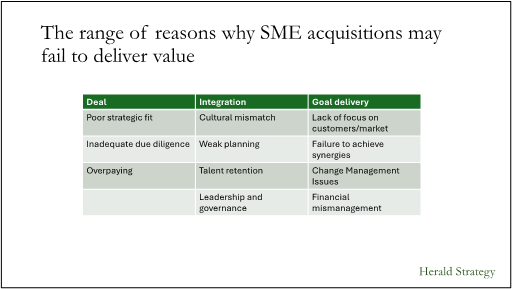

Types of Acquisitions and why they fail

Acquisitions can be motivated by different strategic goals. For instance, you might be acquiring a business to enter a new market, extend product offerings, or gain valuable assets like intellectual property or a specialized workforce. While each situation presents unique challenges, the ultimate goal is the same: integrating the acquired business smoothly and realizing the expected value.

Unfortunately,

many acquisitions fail.

Three insights to focus on for success

1.

Founders and CEOs should lead the process as a takeover, not a combination – successful acquisitions require strong leadership that views the integration firstly as a decisive takeover, and secondly as a blending of two organizations. You, as the CEO, should lead the charge with clarity and decisiveness.

2.

Not everything needs to be done immediately – While it’s tempting to tackle every issue at once, focus on the most critical elements first. Begin with the fundamentals, such as leadership alignment, operational continuity, and customer retention, and build a clear roadmap for addressing other tasks later.

3.

It’s all about the people – Acquisitions are ultimately human-driven processes. Keeping all those that you want to retain engaged, motivated, and aligned with the broader goals is key to ensuring success.

Proactivity is key to success: Reflect on Your Role and Plan Accordingly

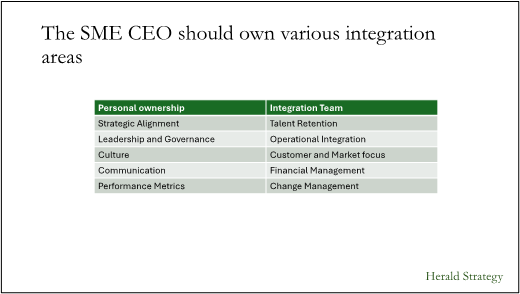

As you approach this process, it’s essential to reflect on your role not only as the CEO but also as the integration leader. The following points offer a lens through which you can evaluate your situation, prioritize tasks, and build a successful integration plan. You will hold the Integration Team accountable for certain goals. That said, in some important areas, you must lead and provide regular oversight.

What does the CEO need to own personally?

The areas that require personal ownership are Strategic Alignment, Leadership and Governance, Culture, Communication and Performance Metrics.

- Strategic Alignment

Ensure that the integration plan aligns with the strategic objectives that justified the acquisition. Core questions to reflect on include: What value am I expecting to unlock through this acquisition? How does each part of the integration contribute to achieving this value? Without clear and measurable alignment to the original vision, even the best-executed tasks may fail to move the needle on business growth.

- Leadership and Governance

As CEO, you need to establish strong governance over the integration process. Who will lead key initiatives? Do they have the time, authority and resources to execute? What do you need to change to create the opportunity for these leaders to succeed? You need to assemble an integration committee and ensure everyone involved understands their role. Leading this committee effectively is one of your personal tasks.

- Culture

Integration can falter if cultural differences aren’t addressed. Being clear to everyone, especially those new to you, about the organizations culture helps set expectations and avoid wasteful misunderstanding. But beware of focusing only on the visible aspects of culture—rituals, language, or symbols. Instead, aim to understand the deeper management practices and norms.

A useful technique here is to identify five core cultural goals and ensure they’re applied consistently throughout the organization. For example, a goal may be Collaboration and Teamwork where regular communication is encouraged, an open-door policy is seen as the norm, and there are investments in software collaboration tools. Consider how these goals can be celebrated and whether delivery should be measured.

- Communication

In any integration, transparency and frequency in communication are critical. What’s the mission? What’s the purpose? Where does everyone fit in the new organization? How do you acknowledge people? As the CEO, it’s your responsibility to lead company-wide communications and foster a sense of shared purpose. Communicate regularly. Consistency will help prevent confusion and build trust during the transition. And use of multiple channels has the best chance to engage the many.

- Performance Metrics

Define new key performance indicators (KPIs) to measure success post-integration. Celebrate quick wins and communicate progress to the broader team. This will build momentum and help integrate both teams into a unified, performance-oriented culture.

Keep the metrics to a minimum number and endeavour to make sure they enter the corporate narrative – known by all and understood as a unifying set of goals.

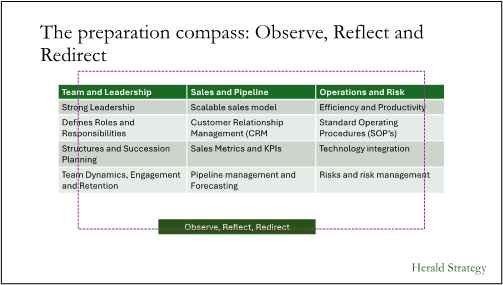

The Preparation Compass: Observe, Reflect, and Redirect

In this complex process, preparation is your greatest ally. Reflecting on your business, understanding its strengths and weaknesses, and crafting a plan of action will put you in the best possible position to prepare the most compelling Information Memorandum with your Investment Bankers, attract a buyer and close a successful deal. Think of this reflection process as a compass—one that helps you navigate and optimize your unique situation.

No two sales are alike, and every CEO faces unique challenges. The Herald Strategy approach is to provide tailored solutions to support you using proven processes. I’ve walked the path you’re about to tread, and I understand the emotional and operational intricacies involved. Our role is to provide a framework and help you reflect deeply on your current state, recognize areas that need fortification, and implement strategies that will make your company a prime acquisition target.

Whether you’re just beginning to consider selling your company or have already started preparing, the time to act is now. Our approach can guide you through the complexities of leadership, sales, and operations to help you achieve the sale you want.

Start preparing today—because preparation is the key to avoiding failure.

What does the Integration Team need to own?

Of course, the CEO cannot lead all aspects of the integration. There are a number where you should hold the Integration Team accountable for certain goals.

Talent Retention

One of the greatest risks in an acquisition is the loss of key talent. Anecdotal evidence suggests that 50% or more of acquired people may leave within 3 years of being acquired and often the seniors go first. Ask the Integration Team to understand who the seniors are and include an analysis of what their departures may mean to customers, staff and suppliers. Implement retention strategies early. And recognize that CEO engagement with these employees can make a significant difference in their commitment to staying on board.

- Operational Integration

Consider how the core operational functions (IT, HR, Finance) will integrate into your current systems. The policies should align quickly but the systems can be lower priority. Many organizations have found that it is easy to get bogged down here and see system change as an end. Look to the Integration Team to ensure that these system changes, if required at all, align with the broader strategic goals and are not treated as standalone tasks.

- Customer and Market Focus

While it’s easy to become inward-focused during an integration, your market and customers should remain a top priority. Ask the Integration Team to prepare retention, expansion and communication plans for the top customers. Establish clear account management structures and review your go-to-market strategies to ensure continuity in customer service.

- Financial and Change Management

Track costs, identify synergies, and set new financial targets to ensure the acquisition is financially viable. Define the changes that must be achieved to deliver the strategic objectives. Make sure there is limited metrics which are widely understood. Keeping close tabs on the financial and change performance will allow you to iteratively course-correct if necessary.

Be bold and act fast to succeed

Every situation is unique, but by staying focused on your customers and your people, communicating clearly, and executing against a well-defined plan, you can unlock the full value of your acquisition. When it comes to mergers and acquisition integrations, be bold, act fast, and ensure your team is held accountable to clear success measures.

For CEOs like yourself, the success of an integration process is as much about your personal leadership as it is about your corporate strategy.

Herald Strategy can help by providing a framework for you to consider the issues and ensure that you and your leadership drive the integration forward aligned with the strategic goals that justified the initiative.

If you want a trusted partner in navigating this journey, reach out to start building an actionable plan.