We have all heard the phrase “By failing to prepare, you’re preparing to fail.”

— yet Benjamin Franklin’s words ring especially true for CEOs looking to sell their companies. Selling a business is more than just putting up a “For Sale” sign—it’s about building a robust foundation long before the transaction even begins. As a CEO of an SME, if you’re planning to sell your company within the next two years, your focus should be on preparing not only the financials but also the often-overlooked aspects that can make or break a deal.

Deals do fail. And this is often very expensive for the seller as it comes long after the Enterprise Valuation is agreed and is well into the transaction process.

Why do deals fail?

I have participated in well over 30 closed transactions and seen at least an equal number of deals which ultimately have not completed. My experience shows that there are three main reasons why deals fail:

- Weak Leadership and Poor Team Dynamics

- Inadequate Operational Processes and Documentation

- Sales and Revenue Instability

There are unique human characters, market circumstances, and resources involved in every transaction. Each scenario is different: you are unique, your business is unique. And yet the core elements that acquirers focus on remain surprisingly consistent. Beyond the financial spreadsheets, cash analysis, KPI’s and profit margins, beyond the market and the competition, buyers perform due diligence on three critical areas: leadership and team, sales processes and revenues, and the operational process and efficiencies.

No one knows your business like you do. Reviewing, understanding and adjusting these elements is your key to making your business an attractive target and avoiding the risk of a deal falling apart. The best practise would be to reflect on what’s there, consider strengths and weaknesses and where necessary make adjustments now – well in advance of appointing Investment Bankers.

Leadership and Team: Building Trust and Continuity

One of the first things a potential buyer examines is the strength of your leadership and the cohesiveness of your team. Buyers are looking for more than just financial performance—they want to invest in a business with a solid foundation for the future. This starts at the top with you, and it extends into your senior team and beyond.

Strong leadership is essential. Is there a clear vision, and is your leadership team capable of executing it? Clearly defined roles and responsibilities within your leadership team give buyers confidence that the company won’t collapse if you choose to leave the picture. Additionally, succession planning is critical. Buyers want to know who will take the reins for the key positions. If they see well-prepared leadership succession in place, it reduces the perceived risk of disruption.

Moreover, team dynamics play a big role in assessment – is there a track record of achieving goals together? Acquirers are looking for a cohesive, motivated team that collaborates effectively. If there’s a lack of alignment or worse internal conflict, it could signal deep issues, making the buyer hesitant. As a Founder and CEO, take time now to assess your team: Are they aligned with the company’s long-term goals? If not, now is the time to address it.

Sales Processes: Scalability and Stability

Naturally, your business’s ability to generate future revenue is a primary concern for any buyer. During the due diligence process, acquirers will scrutinize the strength and scalability of your sales processes. Are you overly reliant on a few key clients, or do you have a diversified, sustainable revenue stream? A buyer wants to see scalability, meaning that the business can grow without significant additional investment or strain.

There are other areas that are often overlooked by sellers, such as robust pipeline management, this is another critical factor. How well are you tracking leads, closing deals, and maintaining customer relationships? Acquirers will look at the structure of your sales funnel to ensure it’s not just surviving but thriving. Moreover, how you utilize technology in the sales process can significantly enhance scalability. Are you using the latest CRM tools and automation to streamline workflows, keep a track of prospect interactions and reduce human error?

Operations: Efficiency and Risk Management

Finally, operational efficiency is an area that acquirers will evaluate closely. The more streamlined and efficient your operations, the more appealing your company becomes to a buyer. They are looking for well-established Standard Operating Procedures (SOPs). If your business runs on tribal knowledge—information known only to a few key individuals—you will risk the buyer walking away.

Another area that sellers often overlook is your risk management practices. Every business faces risks, but how well are you mitigating them? A well-documented risk management strategy demonstrates that you’ve thought ahead and have contingency plans in place, which is critical to reducing perceived risks.

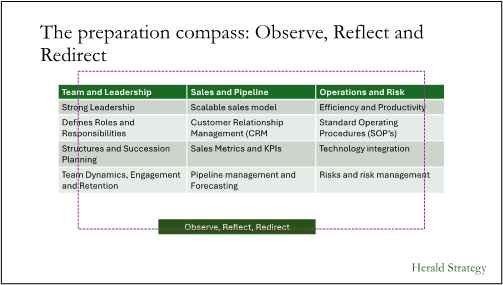

The Preparation Compass: Observe, Reflect, and Redirect

In this complex process, preparation is your greatest ally. Reflecting on your business, understanding its strengths and weaknesses, and crafting a plan of action will put you in the best possible position to prepare the most compelling Information Memorandum with your Investment Bankers, attract a buyer and close a successful deal. Think of this reflection process as a compass—one that helps you navigate and optimize your unique situation.

No two sales are alike, and every CEO faces unique challenges. The Herald Strategy approach is to provide tailored solutions to support you using proven processes. I’ve walked the path you’re about to tread, and I understand the emotional and operational intricacies involved. Our role is to provide a framework and help you reflect deeply on your current state, recognize areas that need fortification, and implement strategies that will make your company a prime acquisition target.

Whether you’re just beginning to consider selling your company or have already started preparing, the time to act is now. Our approach can guide you through the complexities of leadership, sales, and operations to help you achieve the sale you want.

Start preparing today—because preparation is the key to avoiding failure.

Conclusion: successful sales are bult on thorough preparation

Ultimately, while financials and growth prospects are crucial, buyers also want to ensure they are acquiring a stable, well-run organization with minimal risk and a strong cultural fit. Weak leadership, poor operational processes, undisclosed liabilities, uncertainty about sales pipeline and instability, are top reasons why deals fall apart during due diligence. For CEOs planning a sale, preparing thoroughly in these areas is essential to avoid the costs and disappointment of a deal collapsing at the final stages.